Has Apple® changed the game of credit card security?

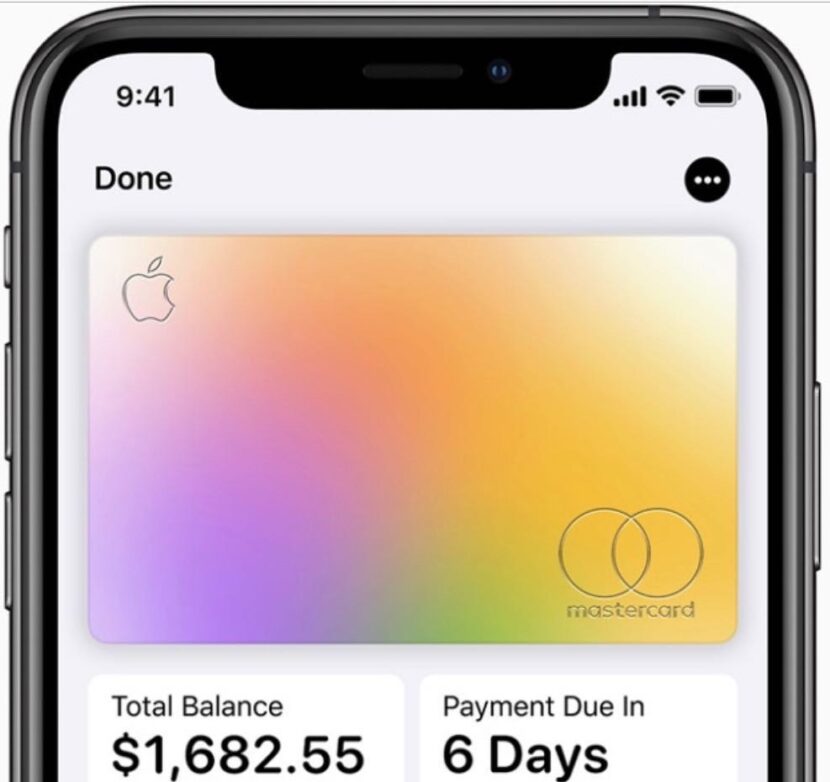

With the new metal Apple Credit Card poised to release this summer; is it safe to say a new era of credit card security is upon us? We pose this question based on a few facts we already know about the new Apple Card™. The following information is NOT found on the new Apple card:

- Omitted expiration date

- No card numbers found on the card body

- No three digit security code

Normally, if a merchant was not able to see the basic card information on your physical card, they would deny using the card entirely. Retailers instruct their employees to look for basic card information found on all payment cards and match that information with the transaction receipt; i.e last 4 digits of the card numbers match the last 4 digits found on the receipt. (see ex 1)

The new standard (potentially)

Essentially, with those aspects of card information removed from the physical card, it makes the card less susceptible to compromise; when handled in public. Twarthing the efforts of some random sketchy waiter that decides to take a photo of your credit card and hook himself up with a new set of yeezys.

So it begs the question… will the major debit & credit card issuers follow in suit? We think this is very possible; in the near future.

For instance, Capital One® currently offers an app where users can manage their card activity, make payments and even lock their cards from being used. The app also allows card users to look up their card number information for online purchases; just in case they forgot their wallet in the car or his wife takes the card on a shopping spree; thanks wifey.

So, why keep any data/information, other than your name and card type logo (Visa|MasterCard|Amex|Discover), on the physical card anymore? It would be simpler to just check the ID and complete the transaction.

How does this change the game?

We believe Apple® has definitely set a new precedent. We also believe if the credit card industry wishes to further protect their card users they should consider following the example of Apple®. Let alone the billions of dollars the credit card industry would save itself in the long run, by removing the temptation of would be wrong doers from copying down someone’s card information.

Ultimately, the less card information you presented in public, the more honest you keep people.

Vincent Torres – CEO – Metal-CreditCard.com