Loud budgeting killed the “broke flex.” But it didn’t kill status.

If the last few years taught people anything, it’s this:

Looking rich while stressing over minimum payments is not the move.

Enter “loud budgeting” – the TikTok-driven trend where people openly say “I’m not spending on that, I’m funding my real goals.” Instead of flexing designer receipts, they flex screenshots of paid-off debt and growing savings.

At the same time, something interesting is happening in the card world:

-

Big travel brands like Southwest, United and Wyndham are rolling out rewards debit cards that earn points and miles – a space that used to belong almost entirely to credit cards.

-

Younger consumers are swiping debit more than credit, but they still want rewards, perks, and yes… a little status at the checkout counter.

So the culture is changing:

Money flex = I’m in control, not I’m drowning but the bottle service looks good on Instagram.

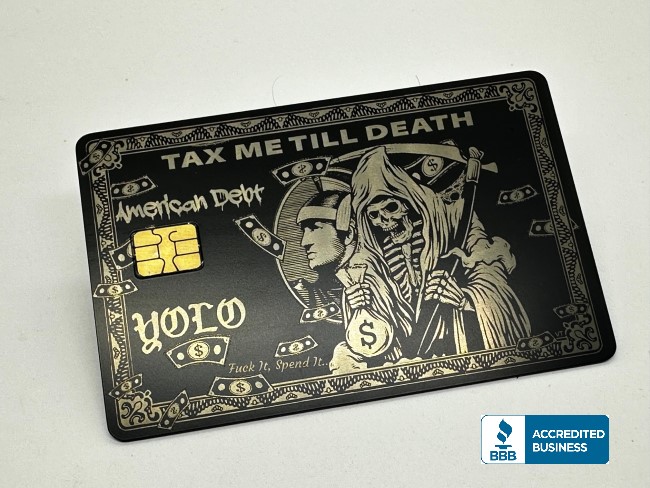

That’s exactly where a custom metal debit (or credit) card from Metal-CreditCard.com fits in.

You can stay loyal to your budget, keep your existing bank and account, and still drop a heavy, laser-engraved slab of metal on the bar when it’s time to pay.

As Vincent Torres, founder of Metal-CreditCard.com, likes to say:

“You don’t need more credit to look important. You just need better metal.”

Trend #1: Loud budgeting – Flexing your discipline, not your debt

“Loud budgeting” blew up because it gave people permission to say, out loud:

-

“That’s not in the budget.”

-

“I’m skipping that trip so I can kill this credit card balance.”

-

“I’d rather fund my emergency savings than another brunch.”

Instead of pretending money isn’t an issue, people are public about their goals—and it actually helps them stick to the plan.

The problem?

Most of the status symbols we’ve been trained to chase (premium credit cards, jumbo annual fees, VIP invites) are still tied to spending more, not less.

-

Want a metal travel card?

Cool—now spend five figures a year and pay a serious annual fee. -

Want lounge access, upgrades, and “member since” clout?

Cool—your lifestyle just got more expensive.

Loud budgeting says: no thanks.

People want:

-

The discipline of a budget,

-

The safety of avoiding new debt,

-

And still a little “respect my presence” energy when they hand over their card.

That’s where the idea of a metal debit card (or an upgraded everyday credit card) makes more sense than ever.

Trend #2: Debit is getting rewards – and it’s not just boring plastic anymore

For years, the message was:

“If you want rewards, you must use credit.”

That’s changing.

In 2025, several major brands—including Southwest Airlines, United Airlines and Wyndham Hotels & Resorts—launched rewards debit cards that let people earn miles and points on debit spending. These cards are being pushed by fintechs and smaller banks who see that consumers, especially younger ones, are leaning into debit over credit.

Key ideas behind this shift:

-

People want loyalty rewards without piling up high-interest balances.

-

Fintechs and smaller banks can structure debit accounts to pay more attractive rewards than the big banks.

-

Travel and lifestyle brands know if they hook your everyday spend early, you’ll stay loyal longer.

So now you’ve got:

-

A debit card tied to a checking account,

-

Earning points or miles on money you actually have,

-

Without the risk of a runaway credit balance.

That’s a loud budgeter’s dream…

But visually, most of those cards still look like every other piece of plastic in the tray.

Which brings us to the third trend.

Trend #3: Status isn’t dead – it just looks different now

Here’s the reality:

People didn’t suddenly stop caring about status. The definition of status shifted.

Luxury and premium research keeps saying the same thing:

-

Today’s luxury buyer (including younger consumers) cares more about quality, uniqueness and self-expression than just a famous logo.

-

Experiences beat big closets, but people still want objects that feel special and say something about them.

And in the card world:

-

Metal cards are still a major prestige signal.

-

Surveys show around 70% of global customers say they’d use a metal card more often than their other cards and over half would even switch banks just to get one.

So even in a loud budgeting era, people still want:

-

A card that feels premium in their hand,

-

Makes a statement at the point of sale,

-

And doesn’t trap them in an expensive card product they don’t really need.

That’s the gap Metal-CreditCard.com has lived in for over a decade:

You keep your current account.

You keep your current bank.

You decide how aggressive or conservative your budget is.

We upgrade the physical card into something that actually matches your standards.

How a custom metal debit (or credit) card fits a loud budgeter’s life

Let’s connect the dots.

A loud budgeter today might say:

-

“I’m cutting back on impulse buys.”

-

“I’m not opening another credit card just to get a metal rectangle.”

-

“If the flex doesn’t fit my plan, I’m not paying for it.”

But that same person still:

-

Cares about personal brand and first impressions,

-

Values well-made, long-lasting items,

-

And wants to feel good about the card they pull out in front of clients, dates, or friends.

A custom metal debit or credit card from MCC lets you:

-

Flex without a new credit line

-

We don’t issue cards or extend credit.

-

We upgrade the card you already own—debit or credit—into a premium metal body.

-

Your bank, your terms, your budget. We just change the way it looks and feels.

-

-

Stay aligned with loud budgeting

-

You can keep using debit as your main weapon—even a rewards debit card if your bank offers one.

-

You still get that “plunk factor” when the metal hits the table, without chasing an annual-fee monster card you don’t need.

-

-

Make your money goals part of your identity

-

Loud budgeting is about saying “I’m proud of the way I handle money.”

-

A custom metal card can be designed around that identity: simple, clean, intentional.

-

No flex about how much you owe—just a signal that you don’t play small with your standards.

-

-

Upgrade once, enjoy for years

-

Unlike impulse purchases that fade fast, a metal card upgrade is a long-term accessory.

-

You’ll see and use it almost every day—at coffee shops, airports, client meetings, date nights.

-

It quietly reinforces: “I take my money and my image seriously.”

-

Real-world scenarios where this makes sense

The loud budgeter who ditched their last credit card

You cut up the card that kept you in debt. Respect.

Now you run your life on a debit card + one responsible cashback/points card. You’re not opening any new lines.

Upgrading your main debit card to metal lets you walk into any room with:

-

A card that looks like it belongs in the premium section,

-

Without reopening the door to old habits.

The entrepreneur who doesn’t want their card to look basic

You run a small business, you meet clients in person, you pick up tabs to build relationships.

-

You might be loud budgeting on the back end—cutting fluff, optimizing margins.

-

But when the check hits the table, you still want your card to feel like it represents your brand.

A custom metal debit or business credit card with your logo engraved tells a story before they even see your website.

The traveler who values rewards but hates fees

You’ve dialed in your travel setup—maybe one solid credit card for flights and hotels, one debit card for everything else.

-

You don’t want three or four premium cards and six annual fees.

-

But you do want something that feels premium in your hand when you’re at a hotel front desk or lounge bar.

Upgrading that main card to metal gives you the experience without the extra products.

Why Metal-CreditCard.com is built for this moment

Metal cards started as a perk for high-limit, invite-only credit cards. Now, demand is exploding across demographics because people want prestige, quality, and self-expression—without necessarily signing up for more debt.

Metal-CreditCard.com was built on a simple idea:

“Let people upgrade the card they already have—not force them into a product they don’t need.”

With MCC:

-

We personalize your existing debit or credit card into a metal body.

-

Your bank stays your bank. Your account stays your account.

-

You keep whatever budgeting system you’re using—loud or quiet—and let the card be the one quiet luxury that shows up everywhere.

Ready to go loud with your budget and quiet with your flex?

If you’re:

-

Done impressing people with balances you can’t afford,

-

Leaning into debit, realistic spending, and actual savings,

-

But still want your card to look and feel like it belongs to someone who moves with intention…

…it might be time to upgrade your plastic to metal.

👉 Next step:

Check out our [Order Today] page and choose the metal card style that fits your personality—matte black, brushed, or fully custom.

Loud budgeting can be your new money strategy.

A custom metal debit or credit card from Metal-CreditCard.com can be the tool in your wallet that backs it up.